Finest Payroll Software in India for Solid Solutions

Amongst all the activities that a business undertakes, payroll management is one of the most arduous and time-consuming. So many processes are supposed to come into play: processing salaries, deduction of taxes, compliance, and the generation of payslips. Every little mistake could lead to consequences that the law would frown upon or an unhappy employee.

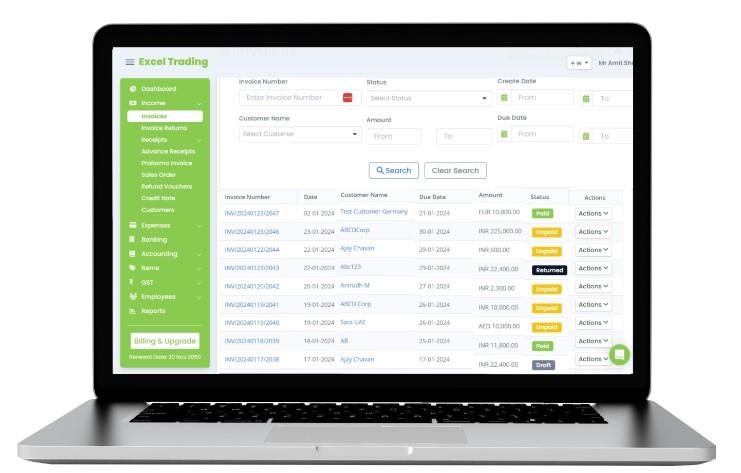

This is where payroll management software India comes forward. It is meant to assist in salary calculation, making compliance with the Indian Tax Act, and issuing payslips without any errors. Hence makes the payroll processing journey smooth and convenient.

Importance of Payroll Software for Businesses

Payroll is not solely concerned with salary disbursement, but it also comprises statutory deductions, tax filings, employment compliance, attendance monitoring, and reimbursement management. When managed manually, these processes are painstakingly long and error-prone.

Companies without any solutions cannot escape the hurdles of missed deadlines and wrong calculations. To eliminate these problems, companies must invest in payroll system software that acts upon the entire process in an automatic manner with utmost guarantees to accuracy.

Good software access to the self-service portals for employees to fetch their payslips, income tax details, any tax documents issued, and leaves records. Such software reduces the burden of HR work while adding transparency to payroll management. In silence, payroll software would relieve companies of the burden of having to manually process payroll accurately while taking hours to work out salaries.

Challenges in Payroll Management

Payroll is more than just paying wages; it involves such elements as tax deductions, compliance, leave and attendance management, and statutory filing. Some of the payroll management challenges faced daily by most organizations include:

• Error in salary computation: It has been known that manual payroll calculations can sometimes lead to unjust payments to employees and, thus, dissatisfaction.

• Tax compliance: Tax obligations such as those relating to TDS, EPF, and ESI are huge tax areas that require constant changes.

• Record keeping: Treating payroll records as valid evidence for audits and help for the employees.

• Losing Time: Manual payroll processing eats into time that could otherwise be used for business promotion.

• Security Risks: Manual processing may lead payroll data to be exposed or accessed without authorization.

The best payroll software in India will solve these hurdles and ease payroll processing all the way through.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Politics

- IT

- Relationship

- Blockchain

- NFT

- Crypto

- Fintech

- Automobile

- Faith

- Family

- Animals

- Travel

- Pets

- Coding

- Comedy

- Movie

- Game

- Computer