Swine Artificial Insemination Market Size, Share & Trends Analysis Report, 2030

Swine Artificial Insemination Market Growth & Trends

The global swine artificial insemination market size is expected to reach USD 3.16 billion by 2030, expanding at a CAGR of 6.67% from 2023 to 2030, according to a new report by Grand View Research, Inc. The market is driven by factors such as increasing demand for pork products, advances in artificial insemination technology, awareness about the benefits of artificial insemination in pigs, and a focus on swine genetics, among others. PIC - a subsidiary of Genus, for instance, reported continued investments in its PRRSv-resistant pig program in 2022. The company estimates final FDA submissions to be made by December 2023. This will enable the company to launch gene-edited PRRSv-resistant pigs and explore tech-based solutions to other diseases.

The market was notably impacted by the COVID-19 pandemic, outbreaks of African Swine Fever, the Russia-Ukraine conflict, and macroeconomic hurdles from 2018 to 2022. However, the increasing demand for pork worldwide has helped the market recover and grow steadily. With the growing population, the demand for pork is expected to increase, and artificial insemination is expected to play a critical role in meeting this demand. As per estimates by OECD, pork meat consumption in BRICS countries is expected to grow from 55.26 mega tones in 2022 to 64.45 mega tones in 2025. The demand and uptake of artificial insemination solutions in pigs are thus estimated to increase over time.

The increasing focus on sustainable food production, animal genetics, and concerns over zoonoses are other factors driving the market growth. Swine producers exhibit increasing awareness of the benefits of artificial insemination, which often translates to increased productivity and better herd health. Swine producers are hence increasingly adopting artificial insemination products and services to breed swine that are more disease-resistant, have better meat quality, and are more efficient at converting feed into meat. Overall, the swine artificial insemination industry is expected to continue its growth in the coming years, driven by rising awareness about the benefits of artificial insemination in pigs and ongoing technological advancements in the field.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/swine-artificial-insemination-market-report

Swine Artificial Insemination Market Report Highlights

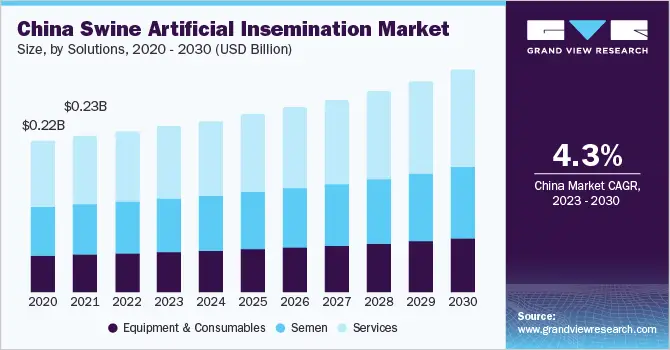

- By solutions, the services segment accounted for the largest share of over 40% of the market in 2022, owing to the availability of a wide range of services and a high uptake

- The semen segment is projected to grow at the fastest rate of over 7% from 2023 to 2030

- The semen segment is further bifurcated into normal and sexed semen. In 2022, normal semen held the highest share of the market while sexed semen is estimated to grow at the fastest rate of about 8% in the coming years

- In terms of distribution channels, the private segment held the highest share of the market in 2022. It is also projected to grow at the fastest rate over the forecast period

- Asia Pacific accounted for the highest market share in 2022 by region. On the other hand, Latin America is anticipated to grow notably at a rate of about 7% in the near future

- The demand for pork products is rising steadily in many parts of the world, leading to an increased demand for breeding services and high-quality swine semen

- Similarly, advances in technology have made artificial insemination more efficient, reliable, and cost-effective, leading to wider adoption of the technique by swine producers

Swine Artificial Insemination Market Segmentation

Grand View Research has segmented the global swine artificial insemination market based on solutions, distribution channel, and region:

Swine Artificial Insemination Solutions Outlook (Revenue, USD Million, 2018 – 2030)

- Equipment & Consumables

- Semen

- Normal

- Sexed

- Services

Swine Artificial Insemination Distribution Channel Outlook (Revenue, USD Million, 2018 – 2030)

- Private

- Public

Regional Insights

Asia Pacific dominated the market by region with a share of about 30% in 2022. This is due to the high population of pigs, the rising adoption of artificial insemination, and the need to meet global animal protein demand more sustainably. As per FAO estimates, the global pig population in 2022 was about 975 million. Of this, an estimated 559 million pigs were in the Asia Pacific alone. China, for instance, is a major pork producer which is expected to contribute to the regional growth.

Latin America region is projected to grow at the fastest CAGR of over 7% in the coming years. In 2022, Latin America was estimated to have the second-largest pig population at about 97 million. Moreover, as per Genesus Inc. the region accounts for some of the largest producers. This includes the BRF S.A. a Brazilian company with an estimated 0.39 million sows and Aurora Alimentos in Brazil with an estimated 0.26 million sows in 2021.

List of Key Players in the Swine Artificial Insemination Market

- Genus Plc

- IMV Technologies

- Shipley Swine Genetics

- Agtech, Inc.

- Neogen Corporation.

- GenePro, Inc.

- MINITÜB GMBH

- Swine Genetics International

- Hypor BV

- Semen Cardona S.L.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/swine-artificial-insemination-market-report

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Politics

- IT

- Relationship

- Blockchain

- NFT

- Crypto

- Fintech

- Automobile

- Faith

- Family

- Animals

- Travel

- Pets

- Coding

- Comedy

- Movie

- Gioco

- Computer